Threat 8: Risk and the Threat

Part 1 framed the fundamental risk question as “How much risk and what kind are they [the threat] willing to take?” This concept underpinned the Cold War concept of Mutual Assured Destruction (MAD). While MAD appeared, well mad on the surface, it recognized that neither side wanted to risk an existential war that would destroy one or both sides and perhaps most of the world. But for MAD to work, it requires:

- A shared understanding of risk.

- A shared will to survive.

- Mechanisms that prevented one side from gaining an advantage that would upset the balance of risk. The Anti-Ballistic Defense Treaty was an example of a risk-balancing tool.

The risk function below is a method to estimate the threat’s willingness to assume risk in their operations. Note, capability and capacity also factor into this estimate. For example, a threat with 20 brigades and a force generation capability may assume more risk than a threat with 5 brigades and with limited capacity to regenerate them.

Risk = ƒ(fear, uncertainty, ƒ(impact, probability), reward)

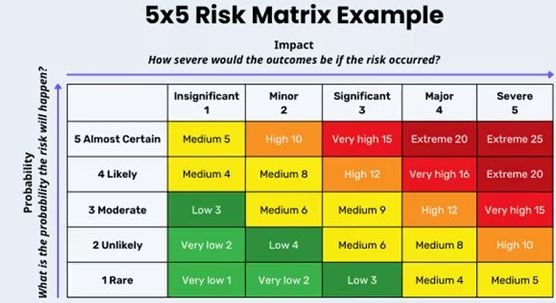

The internal function ƒ(impact, probability) is a standard risk function to determine risk severity as shown below in the figure.

The internal function ƒ(impact, probability) is a standard risk function to determine risk severity as shown below in the figure.

Severity and reward are the standard risk versus reward decision. Fear and uncertainty alter this trade-off. MAD tried to lower fear and uncertainty with treaties and mutual inspections.

Man is the only creature with the power to control instinct by his own will, but he is also able to suppress, distort, and wound it – and an animal, to speak metaphorically, is never so wild and dangerous as when it is wounded. — Aniela Jaffe

Many non-state actors may have limited concerns for fear and uncertainty. Their ideology can insulate them from these factors. Suicide bombers are a prime example. However, leadership may allow fear and uncertainty to influence their actions.

States are generally far more susceptible to fear and uncertainty. This is especially true when regime change is on the table. Consider Iran right now. Its citizens are in rebellion, the US and Israel are poised to attack it, and the goal of all parties appears to be regime change. Regardless of whether the US and Israel seek regime change, the fear and uncertainty are there, especially considering the US forced regime change in Venezuela.

Iran provides a good example of the descriptive nature of the risk function.

When the US attacked its nuclear capabilities, Iran had little fear of regime change or uncertainty about US and Israeli intentions. Therefore, the function collapsed to essentially a simple risk/reward function. They launched missile attacks on Israel, and the US limited its response to shooting down drones and missiles. That encouraged Iran to fire a small-scale strike at US interests in the Middle East that was more of a face-saving response, most likely communicated to the US in advance.

Now, regime change is clearly on the table, and the fear and uncertainty dramatically escalate. This escalation skews the traditional risk/reward balance and potentially causes the regime to take greater risks in its actions. This could get uglier and more violent.

From this discussion, it seems as if the risk function is only appropriate to military and national security situations. That is not so…

I first read James Clavell’s Noble House when I was a young lieutenant in the Army and understood next to nothing about corporate finance and takeovers. The book provides an interesting story of corporate takeovers and provides a good, entertaining overview of corporate regime change. At first, I could not understand how one corporation could take over another—regime change. Then as I read on, I learned about stock markets and corporate takeovers. Then it played out in the news throughout the 1980s and beyond. Corporations engage in regime change, and the risk function works just as well in corporate finance and relations as it does in national security. Even corporations can lash out over fear and uncertainty.